Economic Management under Musharraf and Coalition Rule: Key Lessons for Sustainable Growth

December 12, 2013

Rashid Amjad*

1. Introduction

Over the last 65 years, the Pakistan economy has displayed considerable resilience as it has moved through recurring economic cycles of high economic growth followed by prolonged spells of low growth. Its average economic growth of around 5 percent during this period would be considered respectable by most developing countries’ standards, even though this performance is now clearly overshadowed by the stellar growth rates achieved since the 1980s, first by the East Asian economies, followed by China, and then till recently by India.

Is there a limit to the strain that even a reputedly resilient economy can bear? After being mired in deep stagflation for the last five years (2009–13), there is a growing despondency that the Rubicon may well have been crossed. Breaking out of the current recession will need firm and resolute policy action and a commitment to deep economic reforms. The time to resort to easier options such as external financial support as a means to procrastinate on essential economic reforms has now passed. Neither is external assistance going to be so easily forthcoming after the country’s dismal record of reneging on promised reforms, nor for that matter will it be sufficient. The problem is now much more deep-rooted and structural. It is no longer business as usual to rekindle sustained growth.

Indeed, to many, the immediate priority must be to stabilize the economy and avert a possible meltdown triggered by a looming debt default. The economy needs a strong dose of financial austerity to restore macroeconomic balance before one can give serious attention to the task of reviving growth and moving to a high and sustainable growth trajectory.

This chapter addresses the fundamental economic challenges that confront the economy. In addressing these issues, it does not restrict the analysis to the last five years of democratic rule (2009–13) but covers the entire economic cycle that started in 1999. This has merit in that it allows us to identify the critical economic factors that helped the country break out of the recession of the 1990s, and to assess the revival and acceleration of growth in 2003–07, followed by the outset of the current stagflation. It also has the advantage of not merely blaming one or the other government in power for the problems we now face, but more dispassionately evaluating the relative performance and weaknesses of both in economic management, including the lack of will to undertake fundamental structural reforms.

As we shall see, much of the problem that arose as growth first increased and then plummeted stemmed from (i) the Musharraf government not doing enough to take advantage of the spurt in economic growth, and (ii) the succeeding democratic coalition’s failure in taking the concerted action necessary to revive growth and restore macroeconomic stability. Indeed, by the end of its term, the coalition government could rightly be accused of gross negligence and wanton economic mismanagement.

Section 2 analyzes the movement of key economic variables over the economic cycle to establish the key constraints that prevented the economy from achieving a sustainable growth trajectory after the initial burst of economic growth. These include the low level of savings and investment, the incapacity to raise sufficient revenues, falling international competitiveness, infrastructure constraints—especially energy—and continuing poor human development indicators (HDIs).

Drawing on this analysis in Section 3, we explore the Pakistan economy’s underlying dynamics during this period that appear not to have been fully captured by the broader macroeconomic indicators. This dynamism is reflected in a certain buoyancy and resilience in the economy even during the last five years and could also help explain why certain sectors of the economy have performed well while others remained stagnant or showed lackluster growth. Identifying these factors and the dynamism they create in the economy could also help explain why the labor market and poverty impacts of the current stagflation have been far smaller than what earlier studies had predicted or even why poverty may have declined in this period as some studies appear to show. We also suggest that the size of the economy may be much larger than the official statistics show and this could help explain the rise of the middle class during this period.

A fundamental premise of this chapter is that Pakistan’s poor economic performance is as much due to poor economic management as to structural or other constraints. Indeed, poor economic management is an important reason why these constraints continue to persist. Section 4 therefore assesses how well or poorly the economy was managed over this period in terms of what economic policymakers did right and what they did wrong—most importantly, what they did not do and should have done. In assessing their performance, we also critically evaluate the International Monetary Fund (IMF) agreements entered into and to what extent the conditionalities agreed on were met.

In the last two sections, we suggest policy measures and reforms needed in the short term to regain macroeconomic stability and revive growth, and in the medium and long term to move the economy onto a higher, sustainable, and inclusive growth path.

2. The Pakistan Economy: Bust-Boom-Bust Cycle (1999–2013)

Till recently, identifying the economic cycles through which the country has moved over the years and the factors responsible for them appeared to be reasonably well established. Economists have tended to divide the overall period into cycles of low economic growth, i.e., the 1950s, 1970s, 1990s, and 2009–13, which were also associated with civilian rule, in contrast to periods of relatively high growth, i.e., the 1960s, 1980s, and 1999–2008, which coincided with military rule. These cycles have also been characterized by significant changes in foreign resource inflows as well as with important geopolitical developments such as the Soviet invasion of Afghanistan in 1979 and 9/11 in 2001. Given this association, many economists have, therefore, explained, the spurts in economic growth as having been caused by injections of large foreign resource inflows, and downturns by slowdowns or sharp declines in these inflows.

This dominant view has been questioned by McCartney (2011), who uses rigorous statistical measures to analyze Pakistan’s growth performance and identifies three episodes of growth—1951/52 to 1958/59, 1960/61 to 1969/70, and 2003/4 to 2008/09—and two episodes of stagnation—1970/71 to 1991/92 and 1992/93 to 2002/03. Moreover, he finds no credible evidence for attributing Pakistan’s episodes of growth to foreign aid inflows and circumstances emanating from the global economy. McCartney’s basic hypothesis is that acceleration of economic growth takes place when the state successfully creates conditions in which high profits are generated for investors and channels credit toward them. In addition, he finds no systematic relationship between economic growth and external finance or economic liberalization.

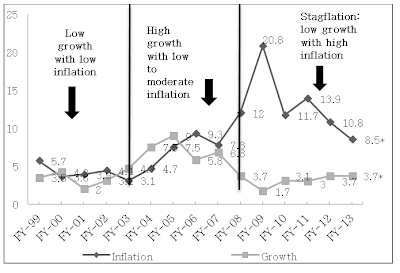

Figure 3.1: Pakistan’s macroeconomic performance, 1999–2013

Source: Pakistan Economic Survey for 2011/12 for FY1999–FY2012; State Bank of Pakistan, Annual Report (2012) for FY2013.

Given the lack of consensus on a general theory explaining Pakistan’s growth performance, the recent economic cycle provides good ground to search for some credible answers. Let us first present some stylized facts that are relevant to the economy’s performance over the 1999–2013 economic cycle.

First and foremost, over almost the entire period starting post-9/11 in 2001, Pakistan has been a frontline state in the war against terrorism. This has taken a considerable economic toll both in terms of direct costs as well as in undermining business confidence, and the severity of the latter has increased over the years. This situation has, at the same time, allowed Pakistan to become a recipient of higher levels of donor funding, both military and development aid.

Second, both governments of this period started under the shadow of a looming debt default though the circumstances responsible for this were quite different. The Musharraf coup took place only a year after the Pakistan nuclear test in May 1998, which had led to the imposition of international economic sanctions including suspended aid inflows and a sharp slowdown in the economy that brought it to the brink of default. The newly elected democratic government that took over in March 2008 inherited a precariously balanced economy with untenably high fiscal and current account deficits, falling foreign exchange reserves, and a strong imminent threat of debt default and bankruptcy.

Third, at the start of their terms, both governments entered into agreements with the IMF to bail them out of their economic predicament. The Musharraf government entered into a one-year stand-by arrangement (SBA) of USD 596 million in June 2000. On successful completion, it followed this with a three-year poverty reduction growth facility (PRGF) arrangement amounting to USD 1.3 billion in December 2001. The elected coalition government that took over in March 2008 entered into a 23-month SBA with the IMF in October 2008 of USD 7.6 billion, which was augmented in August 2009 to USD 11.3 billion and extended through December 2010. It was then extended by another nine months till September 2011. What is important to note is that, during the 13-year economic cycle, the economy was under the aegis of an IMF program over half the time. While these loans helped tide over the immediate economic crisis and restore confidence, they also had important implications for economic management—including the flexibility that could be exercised in policymaking—over these years.

Fourth, throughout this period, the economy was run under an almost open or fully liberalized foreign exchange regime. This meant that residents could open foreign exchange accounts and send out foreign exchange with hardly any restrictions. It is important to note here that many other developing countries—including those like Pakistan who received large amounts of remittances—had liberalized their foreign exchange regimes but not to the extent that Pakistan had done in this period. This meant that the Pakistan economy was much more globally integrated in terms of international capital movements, both legal and illegal, and therefore also vulnerable to global economic fluctuations and meltdowns.

Fifth, the period 1999–2013 saw an almost tenfold increase in remittance flows into the economy, from around USD 1.5 billion in 1998/99 to an expected USD 14 billion in 2012/13. These flows provided critical support to both governments in the face of a precarious current account trade situation in most years. These increases were the result of a significant rise in the number of overseas Pakistanis with higher skills as well as due to a shift in remittance flows from illegal to legal channels following 9/11 and increased vigilance over such flows (see Chapter 11 and Amjad, Arif, & Irfan, 2012). With a Pakistani diaspora now estimated to be around 6 to 8 million (some say even higher), this also points to the strong links between the global and Pakistan economy.

Finally, this period witnessed a series of unfortunate natural disasters: the drought in the earlier years of the Musharraf government, the tragic earthquake in the winter of 2005 in northern Pakistan and Azad Kashmir, and the floods of epic proportions in the autumn of 2010. Their economic and human cost, especially of the last two disasters, was extremely high and, though in the case of the first, substantial international humanitarian assistance was forthcoming, in the case of the latter it was far less, given the magnitude of the disaster.

2.1. Economic Growth and Structural Change

To judge how well the economy was managed over the economic cycle, we examine the behavior of the key variables that are normally associated with economic growth and structural change in a developing economy as it moves up the development ladder toward higher and sustained growth. These include the ability to maintain high levels of savings and investment, the capacity to raise sufficient revenues to meet development and nondevelopment expenditures, increasing international competitiveness, investment in human capital, infrastructure constraints, and trends in poverty.

2.1.1. Savings and Investment

The levels of savings and investment are critical to the economy. Total investment is financed in part by domestic savings, and the gap that remains by foreign savings. The latter includes both foreign loans and grants as well as remittances and net private transfers from abroad. National savings are defined as domestic savings plus net transfers from abroad, i.e., remittances and net private transfers, and are taken as a more accurate indicator of the domestic resources and foreign exchange available for investment, compared to domestic savings alone.

The initial spurt in national savings caused by remittances from abroad—which almost doubled in this period—eased the foreign exchange constraint and contributed to the revival economic growth. However, after climbing to a peak of 20.8 percent in 2002/03, they fell to 13.6 percent with the advent of the democratic government and further to around 10 percent at the end of the period (Figure 3.2). This decline in national savings at a time when foreign remittances were increasing manifold points to the fact, which we will explore further in the next section, that consumption levels were increasing and that the rise in remittances was feeding primarily into increased consumption that was largely met by imports, given the low growth of domestic output.

Note: * = provisional.

Source: Pakistan Economic Survey for 2011/12 for FY1999–FY2012.

Pakistan’s national savings rate, relative to the average of fast-growing developing countries, is much lower and pales in comparison to India’s average of well over 30 percent during the latter’s recent high economic growth.

Figure 3.3 shows that investment levels increased steadily during the Musharraf regime to a peak of 22.5 percent in 2006/07, but plunged during the democratic period when they fell to about 12 percent. This fall reflects both a sharp decline in private investment due to a loss of business confidence but also low levels of public investment due to lack of funding. It should also be noted that Pakistan’s peak investment rate of 22.5 percent in 2007/08 was also far lower than the average achieved by the fast-growing developing countries, as well as by India (over 30 percent) during the last ten years, with China being well over 40 percent.

Note: * = provisional. Figures for “total investment” are taken after accounting for stocks.

Source: Pakistan Economic Survey for 2011/12.

2.1.2. Tax-to-GDP Ratio

As Figure 3.4 shows, there is hardly any significant change in the critical tax-to-GDP ratio over the economic cycle as it averaged around 10 to 11 percent during the Musharraf period and between 9 and 10 percent under the democratic government. The total revenue-to-GDP ratio also stagnated at between 13 and 14 percent. The message here is quite clear. Over this period, both governments were unable to put in place the badly needed tax reform measures to increase the tax-to-GDP ratio from an average of around 10 percent over the cycle to the required 15–17 percent, which is around the average of developing countries.

The failure to increase the tax-to-GDP ratio had severe consequences for the economy, especially when growth plunged and the fiscal deficit reached dangerous levels during the period of democratic government. Indeed, it is important to note how the fiscal deficit initially fell under the Musharraf government due to stabilization and other measures adopted under the IMF program, but that as soon as the government exited the IMF program, the fiscal deficit began to increase. Additionally, when the Musharraf government failed to pass on the unprecedented rise in global oil and food prices in 2007/08, the fiscal deficit rose to an untenable level of near 8 percent.

Figure 3.4: Total tax-to-GDP ratio, 1999–2012

Note: * = figure from the Annual Report of the State Bank of Pakistan.

Source: Pakistan Economic Survey for 2011/12.

Again, under an IMF program that the democratic government entered into, which introduced stabilization measures including cuts in government expenditure—mainly the federal Public Sector Development Program (PSDP)—the deficit fell in 2008/09 but rose once again as a result of the failure to raise revenues and curtail expenditures. In 2012/13, it is expected to be between 6.9 and 7.3 percent. This deficit was financed by borrowings from the State Bank of Pakistan and later through commercial banks. The resulting increases in money supply fueled inflation, which remained in double digits for most of the government’s term in office. Inflation fell in 2011/12 but is expected to increase again during 2012/13.

The fiscal deficit is most strongly reflected in the rising national debt, both domestic and foreign. This increased from approximately PRs 3,000 billion in 1999/2000 to PRs 6,000 billion in 2007/08, and then rose steeply to just over PRs 12,000 billion in 2011/12. Foreign debt rose from approximately USD 28.8 billion in 1999/2000 to USD 60.3 billion as of March 2012 (Pakistan, Ministry of Finance, 2012). More important than the absolute amount of domestic and foreign debt is the burden it can put on the government in servicing and paying back the debt. Therefore, while as a percentage of GDP, total debt declined from 78.9 percent to 58.2 percent by the end of the period, interest payments on domestic debt accounted for a hefty 33.4 percent of current government expenditures. These payments were a major factor in curtailing development expenditure during the period of democratic government.

Again while external debt servicing is currently well within what is considered a safe limit (20 percent of export earnings), the bunching of repayments on foreign debt—especially on borrowings from the IMF as in the case of the 2008 SBA—has put considerable pressure on foreign exchange reserves in 2012/13. This will also be the case in the subsequent year.

It is important to mention here that, in the two years post-9/11, the Musharraf government benefitted from debt relief given by donors, mostly in terms of extending the period of repayment rather than writing off the foreign debt. This resulted in overall debt relief estimated at around USD 13 billion or around 40 percent of the total external debt outstanding in 2000/01 (Siddiqui & Siddiqui, 2001). This provided the space for the government to sharply increase its development expenditures after 2003 and was a factor in reviving the economy.

Note: ** = figure from the State Bank of Pakistan, excluding one-off debt payment of PRs 391 billion for PSE’s debt settlement.

Source: Pakistan Economic Survey for 2011/12.

2.1.3. Competitiveness: Exports-to-GDP Ratio

Pakistan’s Achilles’ heel is its failure to increase its international competitiveness and resulting exports in a highly competitive global economy. How have exports as a percentage of GDP fared over the economic cycle? As Figure 3.6 below shows, there has been no significant change over the period, and exports as a percentage of GDP remain around 11 to 13 percent.

Even more worrying is the fact that Pakistan’s share in world trade stagnated throughout this period (see Chapters 2 and 13) while those of India and China increased significantly—a strong sign of the falling competitiveness of Pakistan’s exports in highly competitive global markets. Pakistan failed, therefore, to take advantage of the opportunity to gain out of the rising share of developing countries as global trade increased till 2008 and the share of industrialized countries fell. Exports never served as a major engine of growth as they had done earlier for many of the fast-growing economies of East Asia, followed by China and India.

Figure 3.6: Exports-to-GDP ratio, 1999–2012

Note: * = author’s calculation based on July–March figures.

Source: Pakistan Economic Survey for 2011/12.

The result is that the trade deficit has risen over the period and it is only because of the tenfold increase in remittances from USD 1.5 billion to over USD 14 billion over the period that the current account deficit remains in check, though there has been increasing pressure during the last two years of the cycle.

2.1.4. Investment in Human Capital: HDIs

The share of resources going into education (between 2 and 2.5 percent of GDP) and health (less than 1 percent of GDP) remained abysmally low throughout this period (Figure 3.7). These amounts are far smaller than those needed (a minimum of 4 percent in education), as well as much lower than those of other countries at the same level of development as Pakistan.

A significant and positive change that did take place during this period, starting in the Musharraf regime, was the very large increase in the amount and share of higher education (i.e., those enrolled in universities offering four-year undergraduate and postgraduate degrees) and in the total education budget. This has led to an increase in university-level enrolment from around 276,000 in 2001/02 (at the start of the period) to nearly 1.4 million by 2011/12, with almost 40 percent of the total being women.

Not surprisingly, Pakistan has been unable to meet many of the Millennium Development Goals (MDGs) to which it had committed. This reflects not just the lack of resources diverted to human development but also a major failure in the delivery of social services and the poor quality of education and health services delivered in the public sector. The share of the private sector in education and health has increased significantly during these years but here too, with certain exceptions, quality issues persist even though it is better than most public institutions and more cost-effective.

Figure 3.7: Expenditure on education and health as a percentage of GNP

Source: Pakistan Economic Survey for 2011/12.

2.1.5. Lack of Infrastructure: The Energy Crisis

During this period, a key infrastructure constraint that emerged besides water scarcity (see Chapter 9) was the increasing gap between the rising demand and supply of energy. This gap arose due to a number of factors, which are discussed in some detail in Chapter 5 and also touched on later in this chapter. Prominent among these were the failure in the Musharraf period to anticipate demand as consumption levels rose in energy-intensive products (e.g., air-conditioners, motor vehicles). This occurred initially due to the availability of cheap credit resulting from a loose monetary policy and then because sufficient steps were not taken to attract private investors to set up or upgrade existing rundown public sector plants to meet this increased demand.

The democratic coalition opted to set up rental power plants to augment the energy supply in the short run; this proved to be a bad decision because the binding constraint on energy supply was not the availability of power generating capacity but the lack of adequate fuel (i.e., imported oil and domestic gas supplies) to run the existing power plants. The shortage of fuel arose due to the difference in the subsidized selling price and cost of production, which led to a large circular debt as the government was unable to meet the full cost of the subsidy. With power plants not being paid their full costs, and even the amounts received not being paid on time, they were unable to use fully the existing generating capacity.

The basic problem can be traced back to the setting up of oil- and gas-fired energy plants through independent power producers (IPPs) in the 1990s when the proposal to build a new dam (Kalabagh) had reached a political stalemate, although the dam would have made it possible to generate electricity much more cheaply.

Indeed, the shortage of energy and supplying it at subsidized prices was responsible for many of the economic ills that the coalition government suffered during its five years. The energy subsidy cut into a large portion of government revenues, reducing development expenditures, and raising the fiscal deficit besides adding to the circular debt. It was a major factor in the abandonment of the 2008-negotiated SBA in autumn 2011 as the IMF insisted on removing subsidies on energy.

Although the coalition government initially raised energy prices and then continued to make adjustments (see Chapter 5), it could never marshal the political strength to remove the subsidy completely. There was vociferous opposition to increasing energy prices, especially in later years, both from opposition parties as well as the coalition partners. The threat of widespread street protests and even occasional riots was strongly feared, though most riots were against the long hours of power outages than higher prices.

Admittedly, the solution to the problem was not easy and as Chapter 5 shows, raising prices was, at best, a partial solution. However, by not taking bold steps to resolve the energy crisis, the coalition government got the worse of both worlds—mounting energy shortages and untenable fiscal deficits, which ended up pleasing nobody.

2.1.6. Growth in Total Factor Productivity

How well an economy combines the use of its capital and labor resources is captured by growth in total factor productivity. This is the additional growth in national or sectoral output after accounting for the increase in the inputs of labor and capital. Data is only available for 2001–08 and, as Table 3.1 shows, there is some improvement in this period compared to the 1990s, a period of low economic growth. Factor productivity growth must have fallen further in the period of the democratic government when growth rates plummeted again.

It is also interesting to compare the growth of total factor productivity with that of India and find that, even during Pakistan’s period of relatively high growth (2001–08), its total factor productivity was only one third that of India.

Table 3.1: Sources of annual growth in total factor productivity in Pakistan and India by sector and reallocation effect

Source: World Bank (2012).

2.1.7. Sectoral Composition of GDP

The lack of productivity growth due to reallocation of labor in Pakistan is reflected in the fact that there is little change in the overall sectoral composition of GDP. The share of manufacturing returned to nearer 20 percent after declining in the 1990s, reflecting its high growth in the Musharraf period, but it did not result in any significant increase in its share of the labor force, suggesting low labor absorption and use of capital-intensive technology mainly in the large-scale manufacturing sector.

Table 3.2: Sectoral composition of GDP and labor force (percent)

Note: Figures for sectoral composition of GDP in FY2011/12 are provisional.

Source: Pakistan Economic Survey and Labor Force Survey (various issues).

2.1.8. Poverty Trends

If there is one possible positive trend over this period, it is that extreme poverty declined. From around one third of the population living in 2000/01 below the poverty line of 2,250 calories (which works out to PRs 55 per day per person at current 2011/12 prices or around PRs 10,000 for a household of six), the data based on household surveys conducted by the Federal Bureau of Statistics shows that poverty had declined to around 12 percent by 2010/11 (see Amjad, 2012). This decline was in both urban and rural areas.

There is some controversy over these results, not just concerning the decline in the Musharraf period, but especially in the more recent period of democratic rule, given the high levels of food inflation and low economic growth. However, other studies suggest that, even if poverty levels did not decline between 2004 and 2010, they certainly did not increase significantly (see Chapter 17 and Arif & Farooq, 2012, which is based on three rounds of panel household data in 2001, 2004, and 2010).

It must, however, be kept in mind that changes in poverty are very sensitive to the poverty line used as well as to short-term economic fluctuations in the economy, especially in rural areas due to years of good or poor harvests. With a slightly higher poverty line, the numbers in poverty increase significantly. What is important to analyze, therefore, is not just the numbers below or above the poverty line in a given time period but the poverty dynamics as households move in and out of poverty. The recent PIDE study (Arif & Farooq, 2012), based on three rounds of the panel survey in 2001, 2004, and 2010, shows that half the rural population in Punjab and Sindh remained poor for at least one period in the last ten years, with the figure for rural Sindh alone showing it to be as high as two thirds.

2.2. Binding Constraints to Economic Growth

The foregoing analysis clearly shows that, over the last ten years, despite the opportunities that arose, there was hardly any significant shift in the basic structure and working of the economy that would have propelled it to move onto a sustainable high-growth trajectory. All the key ingredients needed to achieve this were either missing or had fizzled out after a brief spurt. Low savings, low investment, low revenues, lack of adequate infrastructure—especially the rising energy gap—and poor HDIs all point to the need for strong policy action to break out of the current stagflation.

2.2.1. Sustainable Growth Rate

An important study conducted for the final report of the Panel of Economists (Pakistan, Planning Commission, 2010) shows that 5 percent is a sustainable level of growth for the economy. This is given the resources it can generate to finance investment through savings, as well as avoiding an unsustainable current account deficit. This calculation is based on a long-term 20-year average (till 2006/07) of the savings rate (15.5 percent), the average current account deficit of the last ten years, again till 2006/07 (just over 3 percent), and an incremental capital–output ratio (ICOR) of 4.0.

Based on past trends, the current feasible economic growth rate has two implications. First, if the economy grows faster than 5 percent, it will either hit a savings constraint or a balance of payments constraint. Although it could improve efficiency by lowering the ICOR and generating higher growth, this cannot serve as a long-term solution.

The other implication of growing at around 5 percent is that this rate would be insufficient to absorb the increase in the labor force, which is growing at around 3 percent. Again, based on historical estimates of employment elasticity, the economy needs to grow at 6–7 percent to absorb the increase in the labor force, and indeed faster if the current levels of unemployment and underemployment are to be reduced and respectable growth in productivity achieved.

That the economy grew, on average, at even less than 5 percent over the last five years shows that it was further constrained by supply-side shocks. This includes the rising energy gap, which shaved off 1.5–2 percent of the growth rate that would otherwise have been around 5 percent (Amjad, Din, & Qayyum, 2011).

What, then, are the binding constraints to economic growth that need to be overcome? In the short term, the energy gap must be resolved and the economy’s existing productive capacity utilized better. In the medium term, the challenge is to restore business confidence and attract new investment by creating an environment conducive to business through much needed economic reforms. The overarching binding constraint that needs to be overcome, however, is the low savings rate and low export levels. For the latter, the development of a well-educated and well-trained labor force is essential because in the new global economy, knowledge rather than physical capital will serve as the main engine of economic growth.

Before leaving this section, it may be useful to draw some lessons and add to the current debate on Pakistan’s recurring economic cycles, based on this chapter’s analysis of the last cycle. McCartney (2011) is correct in pointing out that the growth upsurge takes place when there is business confidence and the state creates conditions to boost profitability, which leads to new investment. In the Musharraf period, these conditions were created initially through restoring macroeconomic balance and then through a cheap supply of credit and later by a fast-growing domestic market after the initial export surge fizzled out. At the same time, one cannot discount in this growth surge the increased availability of foreign exchange that resulted post-9/11 from the increase in aid inflows, debt rescheduling, and increase in remittances.

McCartney is also correct in arguing that economic liberalization is not a sufficient condition for economic growth. The constraints to growth that emerged during the democratic coalition period resulted from a combination of factors, namely the security situation, energy shortages, and poor economic management. Undertaking important economic reforms, which would have included further economic liberalization, would have made an important difference to the business and investment environment, but this was in itself not sufficient to overcome the binding constraint to growth in this period.

3. Economic Dynamics

It would be a gross mistake to judge the Pakistan economy’s performance during this period—especially the last five years—simply in terms of the behavior of key macro-variables, however important they may be. While these variables do reflect at a broad aggregate level the state of the economy, they do not fully reflect or capture important dynamic forces that were working themselves through the economy at the same time, and which may well explain the economy’s resilience, and indeed buoyancy, in certain sectors even during these difficult times.

This dynamism emanates from two sources with both positive and negative consequences. The first is a large undocumented economy that traverses not just the informal sector but also the formal economy. Added to this is a large illegal economy fueled by corruption and other practices. The unsettled conditions in Afghanistan and the border belt also contribute to the growth of the informal as well as the illegal economy.

The second is the existence of a large Pakistani diaspora (see Chapter 11) that injects considerable purchasing power into the Pakistan economy, not just through remittances, recorded and unrecorded, but also other flows, legal and illegal. These flows are facilitated considerably by the existing foreign exchange regime, which allows both residents and nonresidents to transfer money abroad with few or no restrictions.

To these two, one must add the large favorable shift in the terms of trade for agriculture and the rural economy resulting from the coalition government’s policies, which increased the prices of agricultural commodities. In particular, the procurement price of wheat rose from PRs 450 per 40 kg to PRs 950 per 40 kg during 2008/09, along with the rising world prices of rice and the domestic prices of other agricultural products, including vegetables, milk, and poultry. This shift in favor of the rural economy injected a large amount of purchasing power, which also resulted in a large increase in consumption and an increase in the demand for labor that was reflected in a rise in agricultural workers’ real wages (see Amjad, 2012). As discussed later, it fuelled inflationary pressures in the economy.

There is an important reason for investigating these and other economic forces that are not sufficiently captured in the official macroeconomic estimates. Over the last five years, the economy has been inflicted by deep stagflation with low growth and high inflation. It faces a severe energy crisis that, according to recent studies, is shaving off as much as 2 percent of GDP (see United States Agency for International Development, 2013). At the same time, companies quoted on the stock market—especially in the food, cement, automobile, and motorcycle sector—are growing at a healthy pace, with sales in the food sector growing at about 20 to 25 percent per annum in the last five years. Corporate profits, according to one source, have grown on average at 15 percent each year in the last five years, which, even after adjusting for inflation and exchange rate depreciation is creditable (see Bloomberg, 2012).

Studies including those in this volume show that, if poverty has not fallen, then it did not significantly increase over the last five years. Almost all earlier studies had projected a very large increase in poverty given the very high rate of food inflation of almost 80 percent over the last five years and the expected rise in unemployment (see Amjad, 2012). Clearly, something else is happening. Is Pakistan a two-speed economy or one that you see and one that you do not see in the official figures?

3.1. Sources of Growth

To gauge the buoyancy in the economy, let us examine the major sources that were driving growth over the cycle in this period. As Table 3.3 shows, if we break down the sources of GDP growth over the period, despite considerable fluctuations mainly due to the movement of national savings, except for a few years when investment contributed significantly to economic growth during the Musharraf years, overall growth was mainly consumption-led. The contribution of exports was, again, limited to the initial few years of the economy.

Table 3.3: Contribution to GDP growth (demand-side), 2000/01–2011/12

Sources: Pakistan Economic Survey (various issues) for FY2003–12. Figures for FY2001/02 from Lorie and Iqbal (2005).

Figure 3.8: Private consumption, FY1999–2011 (PRs million)

Note: Base year = 2000/01.

Source: Pakistan Economic Survey (various issues).

Figure 3.9: Public consumption, FY1999–2011 (PRs million)

Source: Pakistan Economic Survey (various issues).

Figure 3.10: Total consumption, FY1999–2011 (PRs million)

Note: Base year = 2000/01.

Source: Pakistan Economic Survey (various issues).

What factors drove this consumption-led growth during the economic cycle?

The first major factor was remittances, both formal and informal, with the former increasing from around 1.5 percent in 1999/2000 to nearer 5.5 of GDP. The second was the massive injection of purchasing power into the rural economy, as mentioned earlier. The third was that there was no marginal rise in taxes, reflected in the fact that the tax-to-GDP ratio barely increased in this period. Finally, was the generous increase in money wages for government and public sector employees, which more than doubled in the last five years, with a hefty 50 percent increase announced in the budget for 2010/11. Provincial governments also had to follow suit.

Nonetheless, there were other factors at play. The first was the inflow of remittances through informal channels. Though gradually reduced after 9/11 in 2001 due to much stricter international vigilance of such flows, these could even today be as high as USD 4–6 billion, i.e., around 2 to 3 percent of GDP (see Chapter 12). Then there were capital flows in the shape of private transfers, mainly from Pakistan to the Middle East (with Dubai as the hub). Informed sources suggest that these flows might have been as high as USD 8–10 billion in the shape of investments made in Dubai during the Musharraf period. A large part of this money also flowed back sharply after the global meltdown and the collapse of the Dubai real estate boom in early 2009.

There is also what is called the “whitening” of black money (tax evasion, bribes, etc.), which is partly not reflected in GDP, but even where it is (e.g., investment in public sector projects), once “whitened”, it flows mainly into current consumption. Then there are illegal funds generated in Afghanistan and the tribal border belt by the cross-border heroin trade (valued at approximately USD 5 billion a year) as well as money shaved off donors’ civilian aid to Afghanistan by politicians and others (total donor assistance to Afghanistan as civilian aid was as high as USD 8 billion in 2011/12). A part of this money flows into Pakistan and is used to buy houses, properties, and businesses within the country.

3.2. The “Real” Size of the Pakistan Economy

The size of the Pakistan economy in terms of its gross national product (GNP) is estimated at the current exchange rate to be near USD 250 billion in 2011/12. In addition to this, however, there is a significant undocumented economy, parts of which we have identified. What, then, is the “real” size of the national economy?

Recent estimates made by PIDE researchers (Kemal & Qasim, 2012) suggest that the undocumented economy as measured by consumption estimates could be as high as 90 percent of the documented economy. Taking into account other net foreign exchange flows they do not consider, GNP could be as high as USD 500 billion. The methodology used in the PIDE study still needs further refinement and has many shortcomings, but it does suggest that earlier estimates, which put the undocumented or hidden economy near 30 to 40 percent, could be widely off the mark. What needs to be kept in mind is that the undocumented economy is found not only in the informal economy but also the formal economy since registered firms also considerably underreport their production and profits to avoid taxes.

If Pakistan’s GDP is, say, double its current estimated size, this would have important implications, both positive and negative, for judging the performance of the economy. On the negative side, it would show in an even poorer light the revenues that are collected; if most of the undocumented economy flows into consumption rather than savings or investment, this also reduces the extremely low savings and investment ratio by almost half. It would reflect even more poorly on public sector expenditures on education and health and other social sectors, but it would also mean that Pakistan was generating growth with very low levels of investment and, in this sense, using resources more efficiently.

At this stage, our conclusions on the undocumented economy and its underlying dynamics must, at best, be considered conjectural. The important lesson at this stage is that there is a real need to carry out much more research to understand and analyze the macroeconomic dynamics of the Pakistan economy than presently exists, especially to build into the analysis the factors identified in this section. The other is the urgent need to bring the undocumented economy into the legal framework of the documented economy as far as possible, and, at the same time, to ensure that it is better reflected in official estimates of the national income accounts.

3.2.1. A Two-Speed Economy

Since we do not know the size of the undocumented economy at the beginning of the period 1999–2000, even if we had a mid-period estimate, it would be extremely difficult to work out if the economy was growing faster (or slower) than the official estimates suggest. We are, therefore, forced to accept the official growth estimates with the proviso that, in all probability, the actual absolute levels of consumption are much higher and could be almost double that of the official estimates.

This might also explain why, during the recent sharp slowdown in economic growth and period of high inflation, extreme poverty levels either came down or at least did not significantly increase. In a recent study, Amjad (2012) has argued that it is quite possible that the positive developments in factors that affect poverty (remittances, improved terms of trade for agriculture, rising rural real wages) negated or at least considerably dampened the impact of the negative factors (low per capita income growth, high inflation, declining real wages in manufacturing) that cause an increase in poverty.

This much greater size of the Pakistan economy that the chapter suggests and the growth dynamics that it attempts to identify might also explain the emergence of a significant middle class in Pakistan. Based on household surveys and using an “extended” definition of the middle class, Nayyab (2011) estimates that this could constitute 35 percent of all households. The rise of the middle class also explains the rise in consumption expenditure on food items, cosmetics, small cars, and motorcycles.

It is also important to note that, while consumption expenditures rose significantly, they did not result in increased investment. Indeed, investment levels fell by almost half in the period of democratic rule. The fall in private investment is clearly the result of prevailing insecurity as well as severe energy constraints. What this means is that rising consumption in the face of low growth in domestic output leads mainly to an increase in imports.

4. Economic Management

4.1. Decision Making under Different Governments

How well was the economy managed over the economic cycle? Before we set up some criteria to judge economic management, it is important to differentiate between the relative ease and difficulty of economic decision-making under a military government and an elected coalition government working in a democratic polity. It is generally believed that making difficult economic decisions or undertaking economic reforms is easier in the former than the latter. This is primarily because a democratic government is far more sensitive to an adverse public reaction as well as much more vulnerable to the influence of vested interests from whose political support it draws its strength in the electorate. The latter issue becomes even more important when the democratic government is a coalition, as was the case in the period of democratic rule, with different parties representing different groups and vested interests also spread across different regions in the country.

In differentiating between the two periods, we also need to take into account that, under a military regime, the country despite its federal structure actually runs almost as a unitary one, with the provincial governments working very closely and in line with policies laid out by the federal government in Islamabad. In the Musharraf period, even though a civilian government had been installed at the federal and provincial levels in November 2002, the regime still functioned primarily under the umbrella of a military dictator, with his nominees (or those with his tacit approval) running the federal government as well as those in the provinces. In contrast, in the period of democratic rule, there was much greater provincial autonomy and in the largest province, Punjab, the government was run by the main opposition party in Parliament.

It also needs to be recognized that the adoption of the 7th National Finance Commission (NFC) award in 2009 and subsequent adoption of the 18th, 19th, and 20th Constitutional Amendments has considerably increased the power of the provincial governments. As a result, the provinces’ share of resources in the divisible pool, especially the amount they can allocate to development expenditures, has increased significantly. Additionally, with the abolition of the concurrent list, education, health, social services, labor, and other sectors are now dominantly under provincial control. Should there now, therefore, be greater emphasis on economic management at the provincial level, given this devolution of power?

Finally, the reality of a proactive and assertive higher judiciary taking cognizance of economic matters, which earlier it had rarely done, also needs to be taken into account when judging the executive’s freedom in making economic decisions in areas that were earlier considered to be clearly the latter’s domain. In what ways has this empowered judiciary affected economic decision-making by the government?

In terms of economic management, let us judge the performance of both governments in terms of the following criteria:

1. Since both governments entered into IMF agreements to obtain badly needed financial support at the start of their rule, a key question is whether it was necessary to enter into such agreements at all, how well the economic policymakers of the day negotiated the terms and conditions on which these loans were obtained, and finally whether they were able to deliver on the terms agreed.

2. What did each of the governments do right in terms of major economic policy decisions and economic reforms, and what were some of the key mistakes in terms of the cost to the economy to which we can trace the lack of any real improvements in economic performance, which could have galvanized it toward sustainable and higher growth?

3. What important lessons emerge from this overall analysis in terms of results achieved, missed opportunities, and glaring mistakes that can help guide politicians and economic policymakers in the immediate and long term?

4.2. Pakistan and the IMF over the Economic Cycle

Countries turn to the IMF for support almost as a lender of last resort when they face severe balance of payments problems and risk going into default on repayment of loans or simply becoming bankrupt. Pakistan has entered into as many as 11 agreements with the IMF over the last 20 years. Except for two that were successfully completed, all the agreements were scuttled well before completion mainly because of lack of progress in implementing the agreed reform program. The two successfully completed were the one-year SBA signed in June 2000, followed by the three year PRGF availed starting in December 2001, both under the Musharraf government.

When a government enters into an agreement with the IMF, it is mutually agreed that it will take a number of measures to regain macroeconomic stability as well as economic reforms to overcome the structural imbalances and constraints that were responsible for bringing on the economic crisis and help propel the economy onto a sustainable growth path.

In the short term, drastic measures are adopted to restore macro-stability in order to avoid default as foreign currency reserves dwindle, and to restore confidence primarily through a severe compression in demand that is aimed at slowing down the economy, reducing imports, and stabilizing the foreign exchange situation. This demand compression is carried out through a combination of fiscal and monetary measures, with the former concentrated on reducing the fiscal deficit and the latter on reducing government borrowing from the central bank and raising the interest rate to dampen private sector demand. Strict monetary targets in terms of regulating the money supply are set out. It is for this reason that both the finance minister and governor of the central bank sign off on IMF agreements.

These short-term measures are complemented by a series of economic reforms aimed at improving performance to revive growth and move the economy into a position of sufficient economic strength to repay the IMF loan. These reforms encompass taxation measures to increase revenues; opening up the economy to greater internal and external competition to increase efficiency and competitiveness—by lowering tariffs, removing untargeted and unsustainable subsidies, improving the performance of public state enterprises (PSEs), and privatizing public utilities—financial sector reforms to improve the functioning of the banking sector and other financial intermediaries; and reforms to improve governance encompassing the functioning of the civil service, the judicial system, and local government.

As one can see, the economic reform program entered into with the IMF can be all encompassing. Even if there is broad ownership by the government of the need for such reforms, it does tie it down to carrying out these reforms within a strictly monitored timetable, reducing the flexibility of the pace and sequencing of the reform process.

In recent years, because of considerable criticism of the economic costs of entering into an IMF program, given the resulting very low economic growth and rise in unemployment and poverty, the standard programs now include measures to protect the poor and vulnerable through appropriate safety nets. The PRGF perhaps best represents the new IMF facility, which caters to reforming the economy while at the same time emphasizing measures that would help reduce poverty and improve social welfare.

The grey areas in working out the details of an IMF program and its implementation could include the following:

First, the standard IMF model that calculates the needed compression in demand to restore macroeconomic stability and the resulting growth rate can, in many cases, be far off the target with growth plummeting far more than planned.

The second grey area is the sequencing and timing of economic reforms to be undertaken as part of the program. Facing a balance of payments crisis and possible default, the major aim of the government negotiating team is to obtain the first tranche of the loan as quickly as possible and so stabilize the situation and calm the markets. This can result in them promising far more than they can deliver. It is all too well to suggest that the government should take ownership of the agreed program (see Ahmed, 2012) but, in fact, its bargaining position may be weak and can be further weakened if its negotiating team is inexperienced or technically incompetent.

The third grey area is the country’s capacity to pay back the loan in the stipulated time. As part of the program, an exercise is undertaken to gauge this ability, but this is difficult because the projections assume that, if the program conditionality is met, the economy will have regained its strength and be in a position to rebound. In many cases, this is placing far too great a faith in economic reforms to show dividends in a few years after the reforms are introduced. Structural reforms take time to embed themselves in the economy and raise its growth potential. The time for repayment of the IMF loan is, in most cases, far too short to allow this to happen. Not surprisingly, therefore, the country often finds itself unable to repay the loan and is forced to go back to the IMF to pay back the loans it had borrowed in the first place.

The truth is that, in most cases, the government gives very little consideration to repayment and focuses mainly on coming to an agreement and obtaining the loan. It is not, therefore, a coincidence that very rarely do governments publicize the repayment part of the loan obtained, and once the loan agreement is signed, restrict themselves to taking credit for having successfully completed an agreement with the IMF and obtained the loan.

Let us now, albeit briefly, cover the sequence in which the three IMF programs were signed—two by the Musharraf regime and one by the democratic coalition government.

In the case of the Musharraf government, at first, given the strong feeling against the military coup, it was only able to reach a one-year SBA of USD 590 million with the IMF. The economic team used this year to establish its credibility with the IMF with its commitment to faithfully executing the agreed conditions. Over the course of the year, the Planning Commission prepared the Interim Poverty Reduction Strategy Paper (PRSP). This document was accepted by the IMF, which together with the government’s resolve shown to implement economic reforms paved the way for the signing of the three-year PRGF for a loan of USD 1.1 billion in December 2001.

Some may disagree. Did not 9/11 a month before the signing of the PRGF strengthen the hand of the Musharraf economic team negotiating with the IMF? From a pariah regime, the Musharraf government was now a critical partner in the war against terror and Pakistan the frontline state in this conflict.

These ifs and buts remain but, by and large, the Musharraf economic team had also performed well in initiating reforms in key sectors of the economy (Husain, 2003) and formulating a poverty reduction strategy that paved the way for the PRGF to be signed. Over the next three years, the economy stabilized and on the surface there was a surge in economic growth; with increasing business confidence and improving government finances, there was also a steep increase in both private and public investment.

The IMF and the government were euphoric over the results achieved. The government did not even ask for the last tranche of the payment due under the PRGF and informed the IMF that it was not extending the facility. There was talk of the “begging bowl” having been broken, the country’s dependence on loans and aid now a story of the past, and the economy now being well set on a path of unbridled growth.

Now, outside the aegis of the IMF program, however, old habits reappeared. The fiscal deficit began to increase. Imports increased much faster than exports and the current account became vulnerable once again. The “strong” economy began to show signs of weakening. By the time the unprecedented increase in global oil and food prices struck in the course of 2007, the economy had begun to flounder. The government starting in March 2007 faced strong street protests on the ouster of the chief justice of the Supreme Court. The Musharraf government shied from passing on the higher import prices of oil, energy, and food grains to consumers. The interim government followed suit as elections were around the corner. The budget deficit increased to alarming levels. The foreign reserves built up during the good years began to be rapidly depleted.

What needs to be recognized is that the economy was always vulnerable to external shocks, the macroeconomic turnaround had not been sustained, and the gains of the earlier years under the IMF program had been frittered away (see Amjad & Din, 2010). The government, and sadly the IMF too, had got caught up in their own rhetoric and started believing prematurely that they had brought about a structural shift in the economy (see Lorrie & Iqbal, 2005). But was it just “smoke and mirrors” and good public relations? The fact was that, while some real reforms had been undertaken, these were certainly not sufficient or sustained to ride out the economic shocks, and so the economy was poised to stumble.

The democratic coalition government that took over in March 2008 inherited an economy on the verge of financial collapse. The fiscal deficit, as the new government found, was well near 9 percent and the current account deficit at 8 percent. With continuing high oil prices, the foreign exchange resources were being fast depleted and the currency was coming under increasing pressure. There was no option but to resort to a strong dose of stabilization and restore macroeconomic balance and confidence, especially at the outset of the global financial meltdown. A panel of economists set up by the government also reached the same conclusion, albeit stabilization with a human face. But were there any other options besides the IMF?

In the first month, the Pakistan Muslim League (Nawaz) (PML-N) was part of the coalition and held the finance portfolio. Its view appears to have been that, while stabilization was necessary and would be undertaken, there was no immediate compulsion to go to the IMF. It proposed raising domestic resources by utilizing the unspent government expenditures that government departments and autonomous organizations had accumulated over the years, and that were lying idle with commercial banks. The foreign exchange crisis, rising pressure on the currency, and a possible run against the rupee could be resolved through short-term borrowings from friendly countries, raising funds from the Pakistan diaspora by floating bonds, and keeping the exchange companies in check through strong administrative measures. In addition, measures would be taken to attract foreign remittances.

However, once the PML-N left the coalition and the Pakistan Peoples Party (PPP) assumed the finance portfolio, the donors—represented by the major Western governments—appear to have put a major squeeze on them to go to the IMF. Although the PPP-led government did try to obtain some short-term financial support from Saudi Arabia and China, there seems to have been a trust deficit even with its friends, all of whom appear to feel that only the IMF could keep the government on track and enforce badly needed reforms. This was unfortunate because an injection of funds could have given the democratic coalition the time it needed to carefully work through its strategy to stabilize the economy and, if needed, go to the IMF.

It is important to evaluate the IMF’s involvement in the management of the economy with the PPP-led coalition government, not just in terms of what was agreed on under the SBA signed in October 2008. The imprint of the IMF was clearly reflected in the budget announced in June 2008 by the new government. The macroeconomic framework—including growth estimates—was revised downward and annual development plan expenditures cut down, in part to satisfy the IMF. Indeed, it would appear that the government agreed to seek IMF assistance before the budget was announced, and that it incorporated a number of the measures agreed to in the June 2008 budget, even though the SBA was formally signed in October 2008.

To view the October 2008 SBA in isolation is, therefore, not the correct way of evaluating the IMF’s involvement with the new government. By so doing, it has led to claims that the IMF has been soft on Pakistan, some say because of US pressure, and the agreement was generous in the amount pledged—an unprecedented USD 7.6 billion, as well as in the conditionalities agreed on. The reform package was not frontloaded and the fiscal deficit target had been slightly raised to accommodate the newly launched Benazir Income Support Program for direct income support to poorer households (see Sherani, 2012).

This in no way suggests that the measures adopted in the 2008 budget were not needed. Clearly, as said earlier, foreign exchange reserves were falling dramatically and the exchange rate was coming under pressure. The real issue is whether the extent of deflationary measures adopted in the 2008 budget—as well as those reflected in the subsequent SBA signed in October 2008—were of the right magnitude, and whether the burden of adjustment placed on the economy was one that it and the people could bear.

The other issue is whether the situation was so desperate that Pakistan needed to enter into a huge USD 7.6 billion SBA knowing well that repayments would be due after three years of the first disbursement. Again, those involved in negotiating the loan have argued that such a large amount was needed to calm the market and restore confidence in the Pakistan economy.

Others may disagree. Would it not have made sense to initially agree on a smaller program, firm up a medium-term strategy, and then be in a good bargaining position to enter into an agreement, perhaps even a PRGF (which offered much better terms of repayment) as the Musharraf government had done?

In the circumstances, the PPP faithfully carried out the strong stabilization measures agreed on to regain macroeconomic stability. But the price paid was high, given the “malba” or debris left behind by the previous government, which had fallen into economic paralysis in its last year. The results were far worse than anyone had predicted, including the IMF and the Panel of Economists (see Amjad, 2008). Growth plummeted to about 1.7 percent and inflation reached an unprecedented 25 percent—the highest in the country’s history. If this was a soft program, then heaven help Pakistan had it been cajoled into accepting a strong one.

Although these measures restored some stability to the macroeconomic situation, the resulting unpopularity seriously impaired the government’s resolve to carry out the program. To make matters worse, that autumn marked the beginning of the global financial meltdown. As they say, when troubles come, they come in battalions!

Despite what may be termed a promising start to the IMF program—in that a semblance of macro-stability emerged and growth picked up in 2009/10—even after an agreement to increase its size and extend its duration by another two years, the program’s days were numbered. The finance minister who formulated and announced the June 2008 budget was replaced soon after with a hard-nosed banker who had a reputation for getting things done. The SBA was signed under his tutelage in October 2008. He too did not last long (around 15 months), mainly due to his strong commitment to economic reforms and opposition to the policy of setting up rental power plants in a nontransparent manner. The finance minister’s departure in early 2010 marked an important turning point in the way the economy was managed. Though a new finance minister took over, economic decision-making shifted to the highest echelons of the ruling party. Pragmatic politics rather than economic factors became the main criteria in running the economy. Economic reforms were placed on hold, and even the few the new economic team had been able to introduce were soon reversed.

We now turn to some important lessons emerge from the IMF programs adopted during this economic cycle that should be kept in mind for future negotiations:

- Both regimes failed to gauge the initial impact of their respective programs on economic growth. The economy slowed down to standstill levels, making an economic revival that more difficult. This sharp contraction was caused primarily by the compression in demand through a steep decline in the budget deficit to the level stipulated in the IMF program and mutually agreed to. It would appear that the IMF model used to make the projections may be well off the mark. More importantly, it is necessary to be very cautious when agreeing on the targeted fiscal deficit for the initial years, given its very strong impact on economic growth.

- To achieve this sharp decline in the fiscal deficit, the brunt of government expenditure cuts fell on the federal PSDP—the “low-hanging fruit” under both regimes—and this was a major cause of the more-than-expected decline in economic growth, given its deep linkages with the rest of the economy.

- This sharp decline in public development expenditure results in high costs to the economy since the completion of many ongoing projects is lagged with high costs, leading to shortages in badly needed social and physical expenditure.

- The terms and conditions on which a loan from the IMF is obtained need to be worked out very carefully, especially the strategy for loan repayment. This is clearly one of the lessons from the 2008 SBA. There was much euphoria on the size of the loan obtained, but in hindsight with little attention to how it was to be paid back. When the time has come to pay back the loans in 2013, they have put extreme pressure on the country’s low and declining foreign exchange reserves.

- Pakistan’s experience also shows that, in most cases, it turns to the IMF when its economic situation is very desperate and, hence, its bargaining position very weak. It also means that, IMF or not, fairly strong stabilization measures are needed to restore the situation. This failure stems from poor economic management, a failure to make important decisions in time, and reluctance to take remedial measures when needed, e.g., adjusting the exchange rate to reflect the impact of domestic inflation. In undertaking an agreed economic reforms program with the IMF, the need for and importance of undertaking reforms is not as key as allowing oneself sufficient flexibility to pace these reforms and seeking alternative solutions if economic circumstances so dictate. An example of this was the need in 2006 to opt for public sector investment in the energy sector, when the energy gap was fast widening to dangerous proportions and the private sector was not forthcoming. The Musharraf economic team led by the finance minister, who was also Prime Minister, continued under the strong influence of the international financial institutions to hope that the private sector would fill this gap; this turned out to be a mirage.

- One must also keep in mind when negotiating an IMF-driven reform program that its fundamental premise is that a market-driven private sector is the cure for all economic ills. In some cases, this may be the right path to take. What one must, however, avoid is being pushed into an economic reform the consequences of which one has not sufficiently thought through. A good example of this was the decision to “unbundle” and privatize the Water and Power Development Authority (WAPDA), which the IMF and World Bank strongly supported. It should have been kept in mind that WAPDA over the last 30 years had built up its knowledge base and reputation as a world leader on water and energy issues. The cost of giving all this up without first seriously examining options to improve its performance was a serious mistake. This is a prime example of economic ideology trumping economic commonsense. The result has been that the country has ended up with the worse of both worlds—a decentralized, inefficient structure still working in the public sector.

The analysis of Pakistan’s experience with the IMF would not be complete without also saying a few words on the IMF’s own performance in this relationship. It is now clear that the IMF, too, whether under the strong influence of the US, appears to have been either too lenient or too harsh without much consistency, and that its technical skills in the design of at least the 2008 program left much to be desired. There is much that not only Pakistan, but the IMF too, can learn from experience.

4.3. Mismanagement of the Economy: Byzantine Decision-Making

Pakistan’s economic managers are fairly well experienced; they are far from easy pushovers in hard negotiations with international agencies and are fairly adept in economic decision-making. However, from their experience over the 13-year economic cycle, it strongly appears that glaring mistakes were made and that, except for a short-lived economic growth spurt, the economy emerged as weak, if not weaker, than it was at the start.

The discussion below points to some of the controversial decisions made during this period.

4.3.1. Monetary Stimulus: Jump-starting the Economy, 2002–04

At the end of 2002, the Musharraf government found itself in a classical economic quandary. The strong stabilization measures adopted under the IMF program had brought about macro-stability, but the economy was caught in a low-level equilibrium trap of stability with very low growth. The State Bank of Pakistan decided to jump-start the economy with a monetary stimulus by pumping in money at very low interest rates to encourage private investment. It also encouraged leasing and other arrangements to fund expenditures on consumer durables, including the purchase of motorcars. While these measures, together with other favorable developments, ignited economic growth, the resulting monetary overhang fuelled inflation as the stimulus was too strong and its duration too long (see Janjua, 2005). It also fuelled an energy-intensive consumer-led boom. The result was much-higher-than-expected inflation as well as a rising energy gap.

4.3.2. Lack of Coordination Between Finance and Planning, 2006/07

In the Islamabad Secretariat, the Planning Commission and Finance Ministry are adjacent to one another with the two blocks, ‘P’ and ‘Q’, joined by a corridor. Despite their physical proximity, the lack of coordination between the two—indeed, some would say, tension—is responsible for many of the economic ills the country faces.

The best example of this is their lack of timely action to at least contain the energy crisis, since solving it would need much more concerted long-term action. The Planning Commission had projected energy demand based on historical trends. Jump-starting the economy with a loose monetary policy and the Finance Ministry’s implicit backing, together with fast-rising remittances, fuelled consumption and increased energy demand much faster than projected. When the Planning Commission realized its mistake, as mentioned earlier, it proposed setting up short-gestation hydel power plants in the public sector. This was shot down by the Finance Ministry, which argued strongly against any further public investment in energy. WAPDA, instead of taking a strong stand, also decided to kneel before the financial czars.

4.3.3. Electioneering Economics, 2006/07

At the outset of the financial year 2006/07, the economy was precariously balanced and vulnerable to external economic shocks. Inflation was hitting double digits and the fiscal and current account deficits were rising at an alarming rate. This would have been an opportune time to slow down expenditures and allow the economy to cool down. However, it was also the Musharraf government’s last year in power with general elections to follow in the second half of 2007. The Prime Minister-cum-finance minister did not pay any heed to economic advice that would show up any structural weaknesses in the economy and decided to gallop ahead with a targeted growth rate of more than 7 percent to show for his laurels. He cited the very high growth at which India and China were growing. The Planning Commission advised caution but was ignored. Surprisingly, the State Bank also decided to support the government’s stance to target a high growth rate.

When the unprecedented increase in global oil and food prices hit the economy in the second half of the financial year, the economy veered out of control. The current account deficit began to increase. The fiscal deficit also rose because the government, in the face of a strong lawyers’ protest movement, lacked the political strength to pass on higher prices. This shock marked the end of the Musharraf boom. It also showed the difficulty of overcoming an external shock when the economy is precariously balanced. The Pakistan economy faltered well before the advent of the global financial meltdown.

4.3.4. Unprecedented Increase in Wheat Prices, 2008/09

During the wheat “fiasco” of 2007, the government first proclaimed a bumper harvest, allowed the export of wheat, then faced wheat shortages, and had to import wheat at a much higher price. This brought into prominence the need to examine the whole issue of ensuring food security and setting an appropriate procurement price, especially given the sharp spike in world prices for oil and food grains, including wheat.

How should this price be determined? In May 2008, the Planning Commission set up a Food Security Task Force headed by a former finance and agriculture minister, which included a number of prominent specialists in the field. In its interim report (Planning Commission, 2008) in September 2008, it proposed fixing the procurement price of wheat at PRs 950/40 kg. Earlier on, when taking over in March 2008, the new government had increased the procurement price from PRs 425 to PRs 625/40 kg at the start of the wheat-harvesting season. Its justification was based on the premise that, due to adverse terms of trade and rising global prices, the wheat supply had not kept pace with demand and led to the import of wheat at a much higher price. Additionally, as a result of increasing oil prices, the prices of fertilizer and energy had increased, squeezing the further declining profits of farmers. To offset the resulting increase in food inflation estimated by the task force, a comprehensive safety net was proposed, which would rely primarily on the Benazir Income Support Program.

Unfortunately, the task force’s recommendations were never examined seriously. Indeed, after hearing the views of the task force and of the Ministry of Agriculture (which recommended the even higher price of PRs 1,050/40 kg based on the import price), the Prime Minister decided to fix the price somewhere between the two levels recommended.

The decision was ultimately a political one as the PPP coalition government represented large farmers both in Punjab and Sindh. The cost to the economy was ultimately extremely high. The unprecedented price increase injected a large dose of inflation into the economy that took years to work itself through. Moreover, as global wheat prices fell to nearer PRs 750/40 kg by the time the wheat crop was to be harvested, the federal and provincial governments of Punjab and Sindh had to procure large amounts of wheat which they did not have the space to store as well large borrowings from the State Bank that locked in money in the “food” circular debt.

It would have been much more prudent to fix a somewhat lower procurement price (say, around PRs 800/40 kg), but the macro-implications of setting the higher prices were never examined and the fact that global prices could fluctuate in large bands was also ignored.

4.3.5. 7th NFC Award: “On a Wing and a Prayer” 2009

The 7th NFC award is rightly seen as a major step forward in addressing the genuine grievances of the smaller provinces by distributing a larger share of federal revenues to them, and by moving from a single criterion, i.e., population as a basis for distribution, to multiple criteria that encompass size and other variables. Its politics was right and so was, some would say, its timing. But its economics has gone horribly wrong. The award was based on the important assumption that the tax-to-GDP ratio would gradually increase by 1 percent each year. Unfortunately, it has remained stagnant. This has put considerable pressure on federal resources, especially given the large unexpected increases in expenditure on security and law and order. Additionally, no incentives were put in place for the provinces to generate resources and linking this performance to an increased share in the divisible pool of resources.

What has happened is that the provinces, now somewhat flush with funds, have simply not made the effort and taken the politically easier route of not imposing any new taxes (agricultural incomes) or increasing tax rates in line with economic realities (e.g., property tax in the Punjab). Nor has sufficient attention been given to building the capacity of provinces such as Balochistan and Sindh to effectively use these resources.